The GameStop saga was a big story in February 2021. It’s often told as David against Goliath, but I think there’s a deeper pattern that reflects the role of technology.

Over about a week in late January 2021, GameStop stock jumped from below $40 to above $400, before falling back to close at $90 on February 2nd (Marketwatch). (I’ve drawn on reporting in the CSMonitor for material in this piece.)

The main protagonists in the common narrative were the wallstreetbets subreddit and hedge fund short sellers. It was often portrayed as a “David finally beats Goliath” story, with Melvin Capital, one of the hedge funds shorting GameStop, reportedly losing 53% on its investments in January. It’s also a payback tale. Small investors felt they were taking revenge on Wall Street for the 2007/2008 recession in which people near retirement saw their nest eggs wiped out but banks and investment houses (many of whom made reckless bets on sketchy mortgages) were not held accountable. Towards the end of the drama Robinhood, the online trading site used by many of the Reddit investors, drew flak from politicians for announcing that it would no longer allow its customers to buy GameStop, but only sell.

In this telling, the key players are:

- David, played by small traders banding together on Reddit

- Goliath, played by hedge fund short sellers, representing Wall Street

- Assorted Philistines, played by Wall Street and Robinhood

- Assorted Israelites, played by members of Congress and pundits

Of course, it wasn’t as simple as that: some Wall Street firms were buying GameStop alongside the Reddit crowd. For example, Senvest Management, another hedge fund, cashed in its holdings of GameStop and earned nearly $700 million.

The story featured people and groups like small investors, r/wallstreetbets, hedge funds, Congresscritters, and Robinhood. Not much attention was paid to the technology that made this happen:

- social media: convening likeminded groups, amplifying their emotions, facilitating collective action)

- low-fee real-time online trading: bringing small investors into the market on an equal footing with well-heeled hedge funds

As The Economist (the exception that often proves the rule) noted:

Look beyond the memes and the mania, though, and the story tells you something about the deep structural changes in financial markets. The fact that the fast-paced frenzy was possible is a testament to just how frictionless trading stocks has become, aided by technological advances. Shares can be bought on an app while you queue for a coffee, at a price that is whiskerclose to the wholesale price.

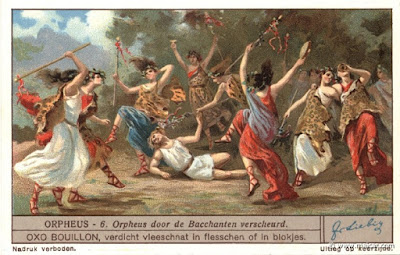

The technology angle is a Dionysus story: a new god appearing in town, being disrespected by the powers-that-be, and whipping up a frenzy among his followers that leads to the destruction of his opponent. It’s a story told in many versions, perhaps most famously in Euripides' Bacchae: Dionysus appears in Thebes to introduce his rites, but is opposed by King Pentheus; at the end of the play, Pentheus is torn apart by the frenzied women of Thebes.

In the alternate telling, the players are:

- Dionysus, played by social media and online trading apps

- Pentheus, played by traditional ways of doing business on Wall Street

- The maenads, played by small traders on Reddit

To illustrate the analogies, here are a few excerpts from the introduction to Euripides’ Bacchae in The Greek Plays: Sixteen Plays by Aeschylus, Sophocles, and Euripides (Modern Library Classics), edited by Mary Lefkowitz and James Room:

Dionysus played a far different role in Greek religious practice than did Zeus and his other children. His worship had broader social reach, including especially women and the poor, in part since his power manifested itself in wine and frenzied dancing, the most widely available routes the Greeks had toward out-of-self experience. But this populist appeal, together with his perceived foreignness and legendary late arrival among the Hellenes, made Dionysus anomalous, perhaps even dangerous, within the hierarchies of the Greek polis. Thus his shrines tended to be placed outside city walls, and his rites often took place in the wild, in unpeopled mountain vales.

…

[Pentheus’] belief system, like his monarchic line, is hierarchical and aristocratic. The idea that new gods can suddenly emerge on the scene, and new rites can spread like wildfire among the disenfranchised, threatens both his most deeply held convictions and the basis of his political power.

…

The mixture of mischievousness, malevolence, and adolescent brashness in this god’s character makes him fascinating to watch.

I’ve highlighted some passages that resonate with the GameStop story. Dionysiac frenzy is now mediated online rather through wine (i.e., electronic rather than biochemical technology); the disempowered in Greek society, women and the poor, are the retail investors that traditionally got a raw deal on Wall Street; the sudden emergence of new practices threatens those in power; and the newcomers look like vicious teens.

|

| “It’s like 4CHAN found a Bloomberg Terminal” |

The application of this myth to other social media phenomena is left as an exercise for the reader.

No comments:

Post a Comment