As Ofcom explained in its 2016 consultation to change the regime in this band (Consultation pdf), a paired guard band of 2 @ 3.3 MHz (1781.7–1785 and 1876.7–1880 MHz) was created in 2006 between GSM and DECT allocations.

|

| Fig 1 from Ofcom's 2016 Consultation on the DECT guard band |

Ofcom held an award process (Auction Information Memorandum) that resulted in the assignment of twelve licenses for use of the bands (announcement).

The process was laid out in the Information Memorandum. The auction would determine whether 7, 8, 9, 10, 11 or 12 licenses would be awarded. It would be a low-power shared-access regime where licensees would have equal rights and obligations to use transmitters, and would be required to undertake engineering coordination with other relevant licensees. All of them jointly were to develop an industry Code of Practice on Engineering Coordination. Each license would have an indefinite duration (with conditions).

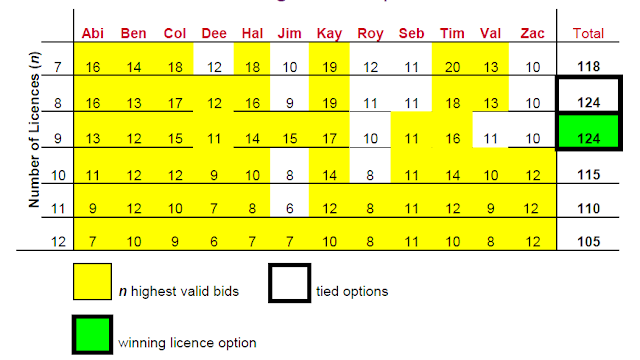

The format was a sealed bid ‘menu’ auction. Each bidder could make up to six separate but parallel bids, one for each of the different numbers of licenses that could be awarded between 7 and 12. Each bidder would be able to win at most one license. The number of licenses to be awarded was that option which received the highest aggregate amount bid. The winning bidders were those that submitted the highest bids for the winning option. Slide 24 in Ofcom’s presentation of the awards process (pdf) illustrates how the winning license option would be determined:

|

| Slide 24, Ofcom seminar on DECT guard band bid process |

On 3 May 2006, Ofcom announced that it had awarded twelve licenses. The prices paid ranged from £50,110 to £1,513,218, and the total amount paid was £3.8 million (I make that about 2 US cents/MHz.POP). Two participants were not awarded licenses because they were outbid.

The auction results were, um, interesting. The number of licenses awarded was the highest on offer (12), and two bidders were left standing. This suggests there was an appetite for more licenses than the maximum number Ofcom allowed. The ceiling was presumably due to concerns about interference (a cursory search of the record didn’t yield any information on Ofcom's thinking) but I can’t imagine that a few more licensees would’ve made a material difference.

A single-round sealed-bid format doesn’t allow for price discovery, and I imagine there was some buyer’s remorse. Ten of the twelve successful bids were between £50k and $300k (a spread of only 6x), with two outliers who paid £1.0m and £1.5m (a 30x spread over the lowest bid). In spite of this wide disparity in amount paid, all licenses had the same rights. The licenses are therefore not really club goods, where conventionally all members pay the same fees.

I don’t know how this band has turned out, but I would not expect it to have been successful.If nothing else, the 2016 proceeding and the conversion to LTE confirms that DECT hasn't been dominant.

I believe (surprise!) that the auction mechanism I proposed to determine the number of club members and a uniform membership fee for mmWave assignments would’ve yielded a better outcome. It would’ve maximized revenue, would not have put an ex ante cap on the number of licensees, would’ve allowed price discovery, and everyone would pay the same price for the same rights.

Update, 24 October 2018

Toby Youell introduced me to Ofcom’s DECT guard band expert, Cliff Mason, who directed me to the table of all offer prices from all bidders for the different numbers of licenses (archived 1781 award). It’s striking that 12 of the 14 bidders were completely indifferent to the number of licensees sharing the band, bidding identical amounts for the (7-, 8-, …, 12-) license options. Of the other two bidders, British Telecom cared little, bidding 9% less for the 12-license option than the 7-license option. Cable & Wireless was the only bidder who had a strong preference for fewer rather than more licenses, bidding £281,002 to operate in the 7-license regime, reducing to £101,002 for 9 licenses, and £51,002 for the 10-, 11- and 12-license regimes.

My guess (with 20/20 hindsight) is that Ofcom left a lot of value on the table: it didn’t reach the regime where the number of concurrent licenses was too high for operators to stomach. I believe a 14-license option would’ve raised a little more money, and everyone who participated in the auction would’ve been able to operate.

Update, 6 November 2018

Toby has written a story for PolicyTracker about our proposal to manage mmWave allocations as a club good ("Researchers propose establishing a mmWave spectrum access club", paywall). It includes a nice survey of the DECT guard band.

No comments:

Post a Comment