According to elementary economics texts, the raw material for any productive activity can be put in one of three categories: land (raw materials, in general), labor, and capital. Some economists mention entrepreneurship as a fourth factor – but none talk about knowledge. This is strange since know-how is the key determinant for the most important kind part of output: increased production. Still, it’s not that strange, since knowledge has unusual properties: there is no metric for it, and one can’t calculate a monetary rate for it (cf. $/acre for land).

An example from agriculture

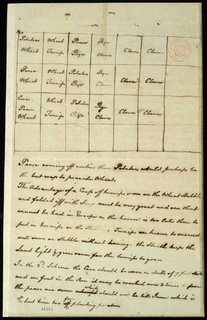

Imagine that you are a crop farmer. Your inputs are land and other raw materials like fertilizer and seed; your labor in planting, cultivating and harvesting the crop; and money you’ve borrowed from the bank to pay for your tractor. You can increase output by increasing any of these factors: cultivating more land, working more hours, or borrowing money to buy better tractor or better seed.

However, you can also increase output through know-how. For example, you might discover that your land is better suited to one kind of corn rather than another. You could make a more substantial improvement in output if you changed your practices, for example by implementing crop rotation. Farmers in Europe had practiced a three-year rotation since the Middle Ages: rye or winter wheat, followed by spring oats or barley, then letting the soil rest (fallow) during the third stage. Four-field rotation (wheat, barley, turnips, and clover; no fallow) was a key development in the British Agricultural Revolution in the 18th Century. This system removed the need for a fallow period and allowed livestock to be bred year-round. (I suspect that if a four-crop rotation had been invented now, it would be eligible for a business process patent.)

Most of the increases in our material well-being have come about through innovation, that is, the application of knowledge. How is it, then, that knowledge as a factor of production gets such a cursory treatment in traditional economics?

Measuring Knowledge

A key difficulty is that knowledge is easy to describe but very hard to measure. One can talk about uses of knowledge, but I have so far found no simple metric.

It’s even hard to measure information content. There are many different perspectives, such as: library science (eg a user-centered measure of information); information theory (measuring data channel capacity); and algorithmic complexity (eg Kolmogorov complexity). All give different results.

One can always, of course, argue that money is the ultimate metric: the knowledge value of something is what someone will pay for it. However, this is true for anything, including all the other factors of production. The difference is that land, labor and capital all have an underlying “objective” measure. One cannot calculate a $/something rate for knowledge in the way one can for the other three.

Let’s say land is measured in acres and labor in hours, and money in dollars. You’ll pay me so much per acre of land, so much per hour of labor, and so many cents of interest per dollar I loan you. Land in different locations, labor of different kinds, and loans of different risks will earn different payment rates.

Knowledge does have some value when it’s sold, e.g. when a patent is licensed or when a list of customer names is valued on a balance sheet. However, there’s no rate, no “$/something” for the knowledge purchased. That suggests that the underlying concept is indefinite. It is perhaps so indefinite that we are fooling ourselves by even imagining that it exists.

Treating knowledge as a physical object

The Knowing Is Seeing metaphor is pervasive and intuitive, and an essential part of our philosophical toolkit via Descartes’ work (see Ch.19 of Lakoff and Johnson’s Philosophy in the Flesh (1999) for a detailed discussion). The metaphor treats an Idea as an Object Seen, Knowing as Seeing, Knowing an Idea as Seeing an Object, etc. The catch is that the objects that we think with in this metaphor are, necessarily, objects – and physical objects don’t behave at all like ideas. Most importantly (regular readers will have seen this coming a mile off, and winced at the prospect of the deceased pony being thrashed again), objects are rival, and ideas are non-rival.

This little problem has always been present in economics, but it hasn’t been critical since knowledge has always been wrapped in stuff. Until the advent of software packages like TurboTax, one bought expert advice by the hour from a person. The advice was intangible and non-rivalrous, but its carrier wasn’t; if I was using the accountant’s time, you were getting less of it. However, knowledge embodied as software is “doubly non-rival”; not only is its knowledge content non-rival, but the software itself is too: my use of TurboTax doesn’t diminish your ability to use your copy.

The bottom line

As the economy is increasingly built out of knowledge, and as the absolute cost of physical goods continues to drop, we are effectively sloughing the husk of stuff off the knowledge we depend on. Managing our way into the future effectively is forcing us to think more keenly about knowledge as a factor of production.

To use ten dollar words: the intersection of epistemology and economics is a necessary and fruitful area of research as the knowledge economy grows in importance